Navigating EU Tariffs: How Chinese Automakers Are Leveraging Hybrids to Maintain European Market Presence

In response to the European Union's recent tariffs on Chinese electric vehicles (EVs), effective from October 31, 2024, Chinese automakers are strategically shifting their focus to hybrid cars to sustain and grow their presence in the European market. This pivot not only underscores the adaptability of these manufacturers but also highlights the evolving dynamics of the global automotive industry.

Understanding the EU's Tariff Policy

The European Commission introduced tariffs of up to 45.3% on Chinese-made battery electric vehicles (BEVs) to counteract what it perceives as unfair subsidies provided by the Chinese government to its domestic EV manufacturers. These measures aim to protect the European automotive industry from being undercut by lower-priced Chinese imports. However, it's important to note that these tariffs specifically target BEVs and do not extend to hybrid vehicles, including plug-in hybrids (PHEVs) and conventional hybrids.

The Strategic Shift to Hybrids

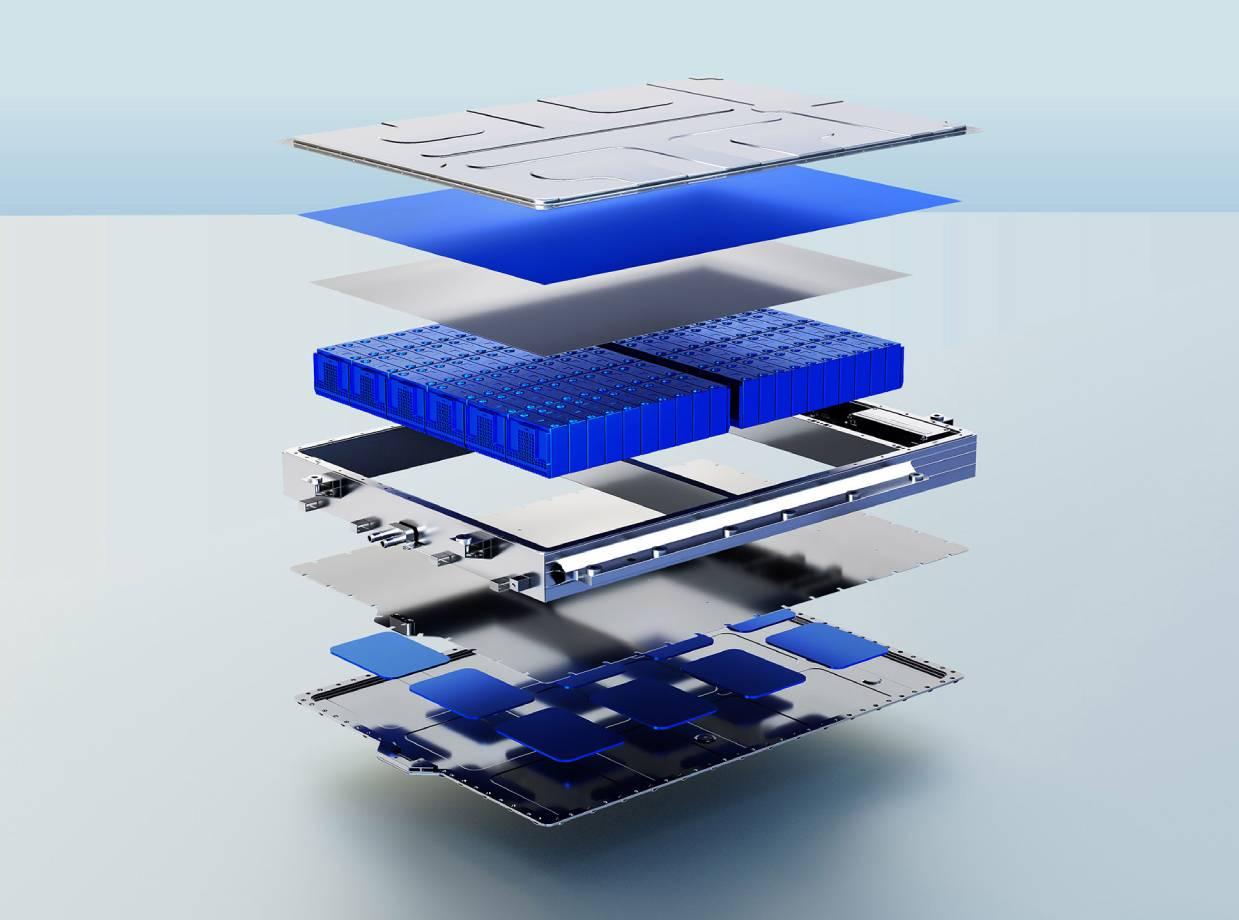

Recognizing the exemption of hybrids from the new tariffs, Chinese automakers such as BYD, Geely, and SAIC have accelerated the development and export of hybrid models to Europe. This strategic move allows them to circumvent the financial impact of the tariffs while continuing to offer competitive vehicles to European consumers.

-

BYD: Launched the SEAL U DM-i, its first plug-in hybrid model for the European market, priced competitively at approximately €35,900.

-

Geely: Introduced models like the Galaxy Starship 7 PHEV and the Azkarra mild hybrid, catering to a range of consumer preferences.

-

SAIC: Expanded its hybrid lineup with offerings such as the MG6 PHEV and the MG EHS Plug-in Hybrid, aiming to capture a broader market share.

This pivot has led to a significant increase in hybrid vehicle exports from China to Europe, with over 65,800 units shipped between July and October 2024, more than triple the volume from the same period in 2023.

Implications for the European Automotive Market

The influx of competitively priced Chinese hybrids presents both opportunities and challenges for the European automotive market.

-

Consumer Benefits: European consumers gain access to a wider array of affordable hybrid vehicles, potentially accelerating the transition to more sustainable transportation options.

-

Market Competition: European and Japanese automakers, traditionally dominant in the hybrid segment, face increased competition, prompting innovation and potential price adjustments.

- Regulatory Considerations: The EU may need to reassess its tariff policies to address the growing presence of Chinese hybrids and ensure a level playing field for all manufacturers.

Looking Ahead

As Chinese automakers continue to adapt to international trade policies, their emphasis on hybrid vehicles demonstrates a commitment to maintaining global competitiveness. For European consumers and policymakers, this development underscores the importance of strategic planning and adaptability in the face of evolving market dynamics.

The ongoing interplay between trade regulations and automotive innovation will undoubtedly shape the future of mobility in Europe and beyond.

Note: This article is for informational purposes only and does not constitute an endorsement of any specific vehicle or manufacturer.

Dejar un comentario

Este sitio está protegido por hCaptcha y se aplican la Política de privacidad de hCaptcha y los Términos del servicio.